A bubble happens when excitement and speculation push tech company valuations far beyond their real economic value; eventually reality catches up and the bubble bursts.”

While simplified, this description is accurate. The problem arises when people assume bubbles appear out of thin air, with “nothing of value hiding inside but a void made out of lies and vaporware.”

In reality, “bubbles are simply an unhealthy extension of the real value lying at the center.” As Sam Altman said, there is always a “kernel of truth.”

Investors buy into that kernel — first with belief, then with money — until “the bubble implodes, killing most of them in the process, but preparing the soil so the few winners can thrive.”

Are We in an AI Bubble?

“Altman himself acknowledges this PR-unfriendly possibility.” While he claims AI and semiconductor investment is based on fundamentals, he admits “speculative capital is growing.”

The question is not whether there is a bubble, but whether “we are getting nothing out of it. Not really. We will get a new normality.”

Yet this bubble may be worse than previous ones. “Bubbles are the collective by-product of individually good intentions… an inevitable and welcome interstitial phase between selfish short-termism and long-term progress.”

But when optimism overwhelms pessimism, “moronic hype-cycles spiral into such gargantuan monsters of delusion and detachment (‘we will build the machine God’)… Bubbles build the world, but they destroy it first.”

Economic Dependence on AI Speculation

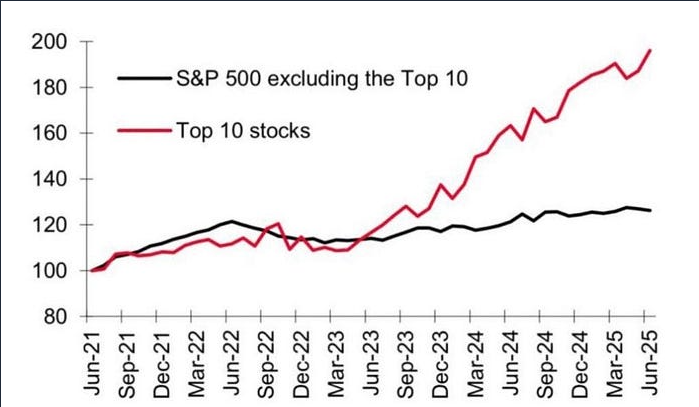

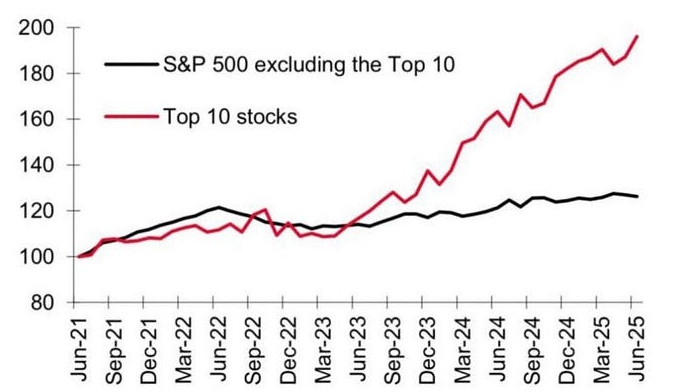

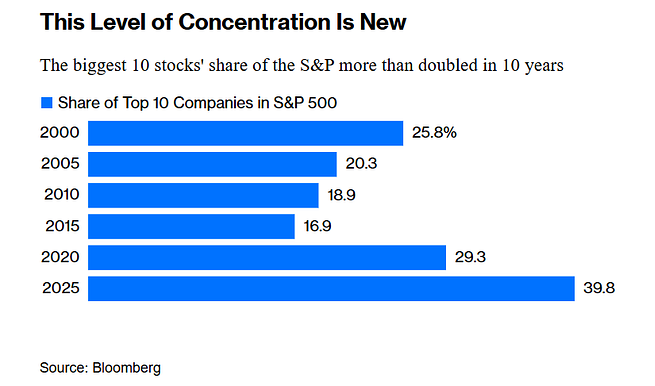

Writer Freddie deBoer warned: “At present the world economy is being propped up by the LLM bubble to a degree that’s truly frightening.” Charts of the S&P 10 versus the S&P 490 show “an ugly divergence,” suggesting that “it’s just 10 companies doing really well, while the broader economy is in contraction in real terms.”

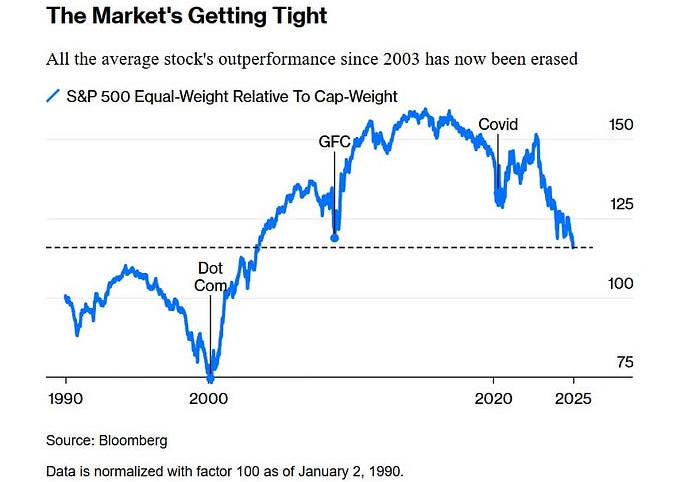

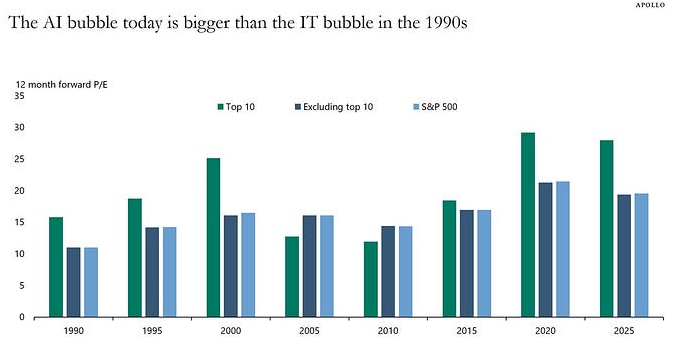

Torsten Sløk noted that “the top 10 companies in the S&P 500 today are more overvalued than they were in the 1990s.” Bloomberg added: “It’s unheard of for 2% of the index’s companies to account for virtually 40% of its value.”

Those companies are Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta, Broadcom, Berkshire Hathaway, and Tesla.

Their massive spending is concentrated on “building datacenters… to train and serve large language models like ChatGPT.”

Capital Expenditures Without Returns

Christopher Mims highlighted: “The ‘magnificent 7’ spent more than $100 billion on data centers and the like in the past three months alone.”

Paul Kedrosky compared this overinvestment to GDP proportions, quoting Xi Jinping’s warning of “overinvesting in AI-focused datacenters.”

Despite these investments, “generative AI… won’t be making a dent in economic charts anytime soon if 95% of pilots are failing.” Whether due to “a learning gap, integration delays, unreliable workflows, or simply that generative AI is not that useful,” the productivity gains expected from AI remain absent.

The Bleak Reality

“When you hype an innovation so hard and so often, people expect the results to manifest by themselves. ‘Do I have to take a prompt engineering course? Fuck off, where’s my ‘magic intelligence in the sky’ that’s ‘too cheap to meter’?’”

Costs are no longer falling: “the cost of serving new AI models… is no longer coming down on a per-token basis,” meaning engineering optimizations are exhausted. Meanwhile, “user adoption is plateauing at <50% in the US.”

Sam Altman may be correct that there is a “kernel of truth” in the AI bubble. But “the financials of that kernel are trickier than they were during the IT bubble in the 90s.” And, as the article closes, “any person on the street will confirm that’s bad news